Sample Reports

"This industry is built on having as much information as possible at your fingertips. We prefer to receive more information than the minimum which is required by the instructions. As we receive fewer details, the possibility of an audit increases dramatically."

-IRS Services Center

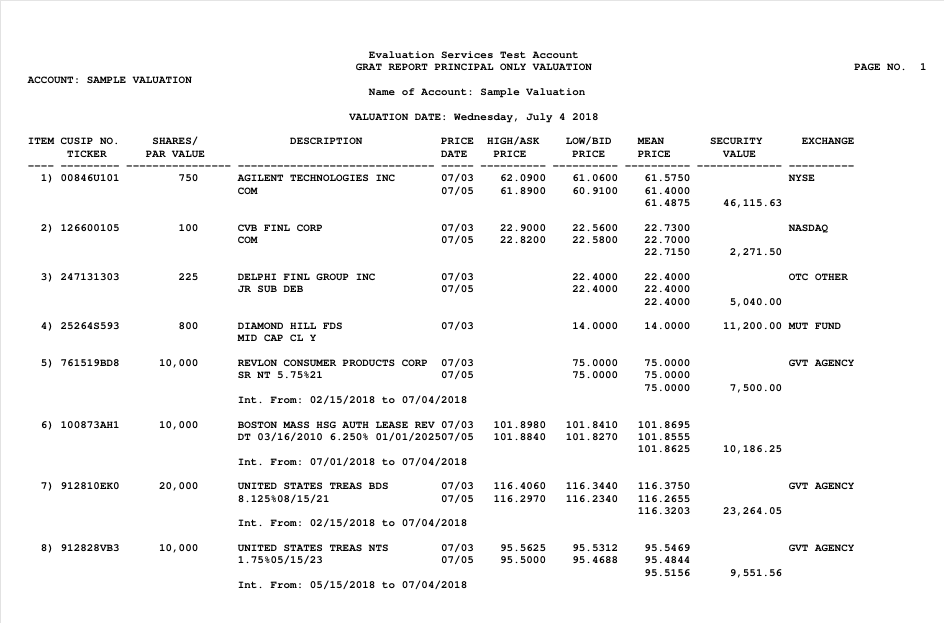

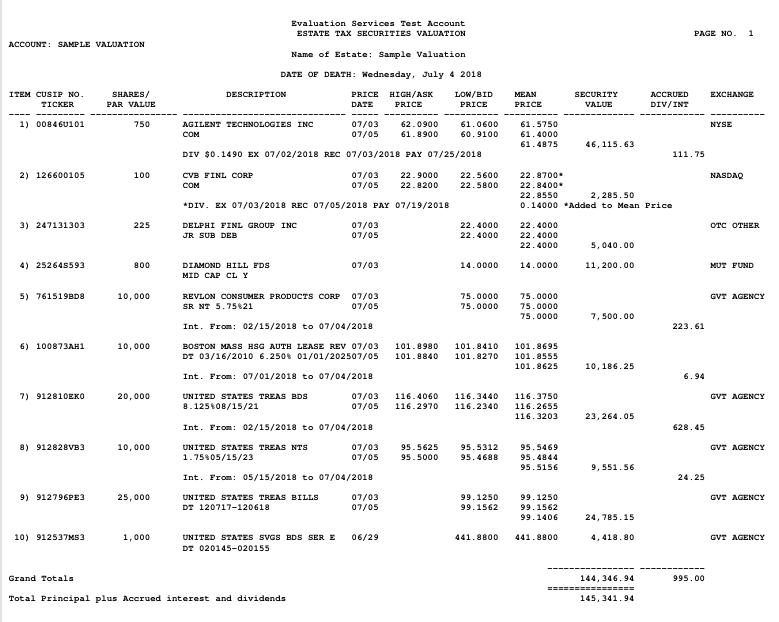

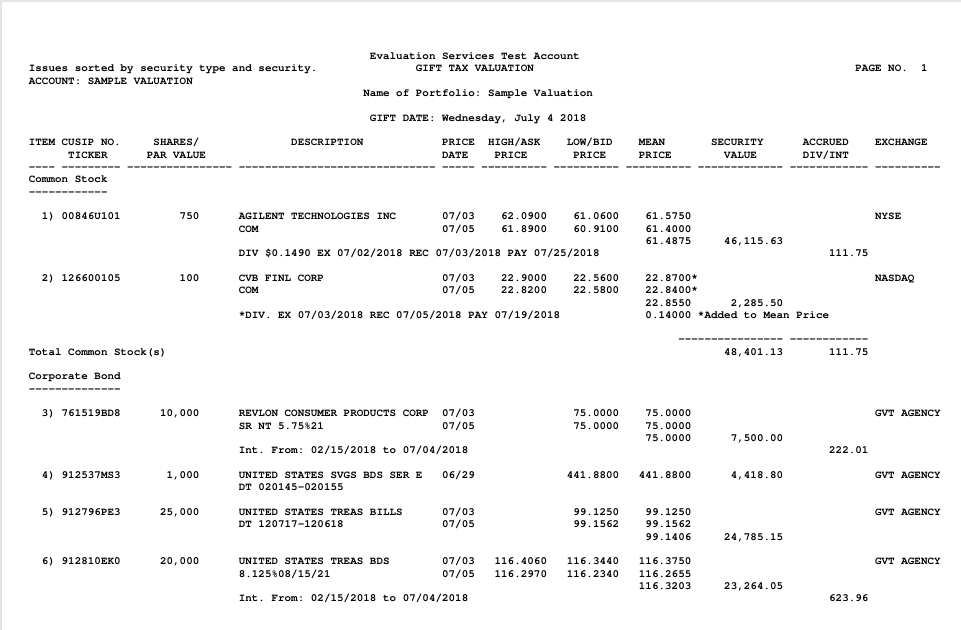

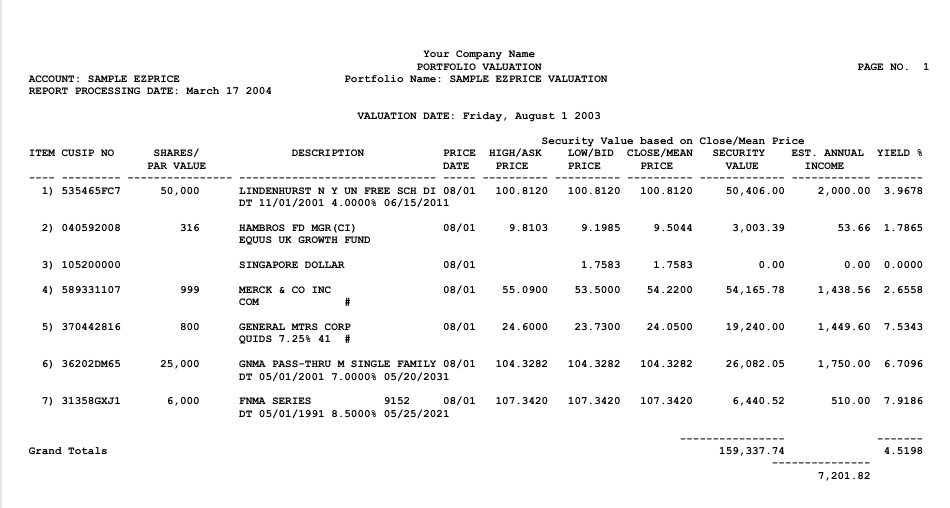

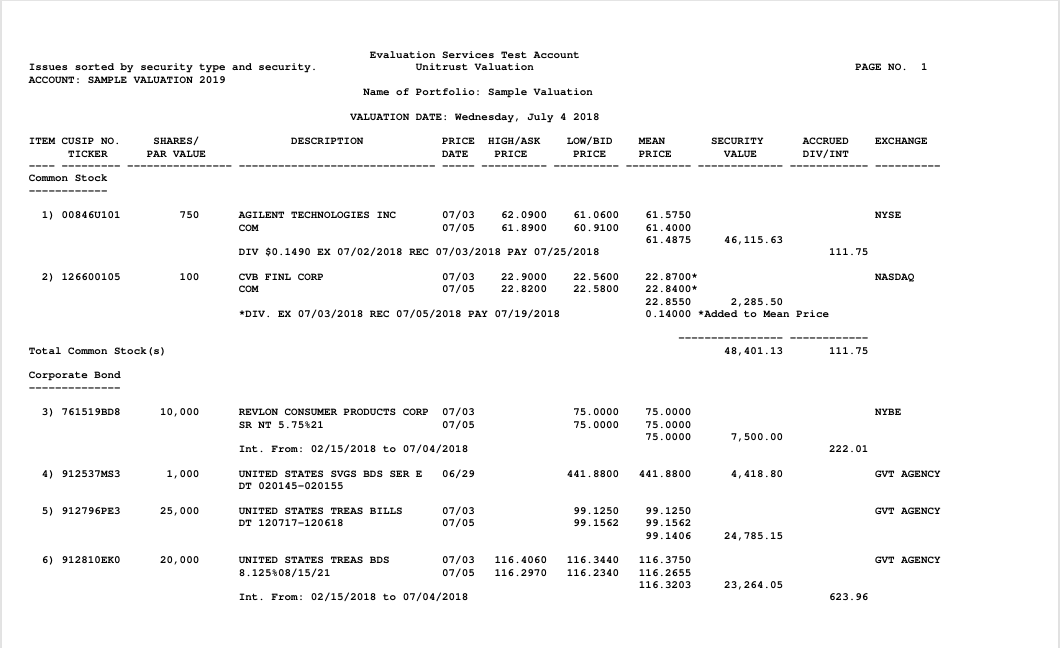

Appraise reports speak for themselves. As you can see by reviewing our sample reports below, they are well organized, fully detailed and easy to read. Each report includes all the information required by the IRS and more.

Most of the securities pricing you find on the Internet will only provide you with a portion of the securities data you need to file an accurate estate or gift tax return. The use of these services to calculate IRS Form 706 (Estate Tax) or IRS Form 709 (Gift Tax) reports can result in incomplete and inaccurate reports that could lead you to an audit.

Further, because back-up data is often required to document pricing information, Appraise features an exclusive Supplementary Report that documents and verifies the accuracy of all information reported.

Appraise provides all the information you need.

Scroll the mouse pointer over each card to see which report options are available for that category.

*Touch if on mobile*

Then, click on an option to see a sample.

IRS Form 706 - Estate Tax

IRS Form 709 - Gift Tax

EZPrice: Portfolio Pricing

Charitable Remainder UniTrust (CRUT)